Macrotech Developers (Lodha Group) got listed post IPO: Should you buy?

Lodha Group launched an IPO between 7th to 9th April and got listed on 19th of Aril 2021. Many reports and many opinions have floated. Although largely positive imagery was given in the current scenario many were also apprehensive of the purchase which is currently at a valuation of 30 PE and excess of 5 PB. But is it really expensive? Let us take a deeper dive into the company and try to find out!

Company Overview:

Lodha Group is the largest Real Estate Company in India with projects in cities like Mumbai, Pune, Hyderabad & London. Between 2018 and 2020 they have made sales of ~Rs: 35000 Cr. In FY20 they had a revenue of Rs:12440 Cr making them the largest real estate player. Their EBITDA margins are somewhere around 30%. They cater to all segments of Real Estate consumer, from Luxury to Low Cost. They have Brands which are established in all those segments. Currently they have delivered in excess of 7.5 Cr Sq Ft and ~7.4 Cr Sq ft are under development. These are BIG numbers. fo

Company Strengths:

The strength of the company are – Their Team, Their Project selection, branding & Execution, Their Distribution & Marketing, Their Scale.

Their Team: The Management (Mangal Prabhat Lodha, Abhishek Lodha) has decades of experience in carrying out real estate projects of scales which were previously unheard of. Take for example – Palava, a 4000 acre City Plan, with everything within was not something that anybody attempted before at that scale. Their execution/delivery like their sales is largest in terms of volumes on an ongoing basis.

Then we talk about Marketing and Sales, they have extremely experienced, creative and aggressive Team which since last couple decades has changed the way the industry functions. They currently have Sales & marketing Team strength more than 500*. This team creates campaigns and then executes sales through ATL and Channel marketing with a certain dedication & force which enables them to sell in unmatched volumes.

Their Project Selection, Branding & Execution: They have tried to create new milestones in creating brands and fresh propositions in a segment like real estate and many times they have succeeded too. Examples can be Palava – a new urban area created in Dombivalli, The Park – A hill-view escape experience in the seemingly congested South Mumbai (SOBO), The World Tower – Again a landmark project in South Mumbai, Belmondo – A successfully executed second home destination near Pune, Altamount – A project opposite to the Antillia. Lodha UK is selling the costliest of Apartments even in 2020 at its project near the US Embassy named – No.1 Grosvenor Square.

Akshay Kumar is the brand ambassador for Lodha Group, which has always roped in the best for the promotion of its projects with stars like Aishwarya Rai for the Park, Amitabh Bachchan for Palava and likewise in the past.

Their Distribution and Marketing: In Mumbai, especially in branded real estate across India, a large portion of the sales is carried out through Channel Partner network who are RERA (Authority) registered. Lodha is one of the companies who has leveraged this network and is one of the pioneers in launching schemes that attract and retain such network over years of time. Their current network in Mumbai and PAN India is more than 2000 Strong who do referral marketing, tele-marketing & Digital Marketing to produce the numbers that we see. This Network is Supported & Managed by the Sales Team of Lodha.

Their Scale: Last but not the least, their large scale helps them procure materials and strike deals at lower cost per square feet. Also this allows them to maintain a large Team which executes its tasks in different departments starting from design & planning, construction, inventory management, branding and marketing to Sales.

ENOUGH TALKS, NOW LETS DISCUSS THE NUMBERS. Whenever we see high Debt to Equity Ratio our heads spin, and yes DE Ratio of Macrotech Developers is north of 4 which is very high. But we must remember that Debt is not paid through equity, it is paid from the revenues and cash flows from Sales. Here we will compare Macrotech with the top five listed Real Estate Entities in terms of Market Cap and try to look at their cash generation.

Let us Compare Revenue to Market Cap of the Real Estate Players: Revenue to market cap simply indicates how much Sales you are buying at What price. Lets look at the numbers:

We have taken the top five developers here (in market cap). And as you can see most of them are far more overvalued than Macrotech when it comes to Market Cap: Revenue Ratio. Macrtotech is 1,81 while 4 out of the above five are above 10 and one is above 20. “ That is Ok.. But What about the Profits?”

So now we compare the last 12 months PAT (Profit After Tax) to Market Cap for the Same Developers:

In many reports of the IPO I found that it was being considered that Price to Earning is very high compared to many other ‘good options’ in the domain. Price to Earnings is same as Market Cap to PAT (Profit after Tax). You for yourself can judge that the numbers are almost at par with the best valuation of Developer 3 which is a top branded player in Mumbai. Their OPM (Operating Profit Margin) is on the lower side, partly because more than 50% of their business comes from mid to low cost housing which is very fast moving but margins have to compromise with. It is only because of the scale that they are a dominant and profitable player in that segment. Their EBITDA of ~30% is decent. “That is also true. but what about consistency of performance? “

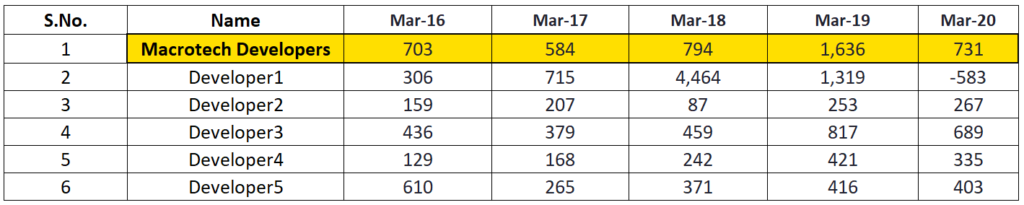

Let us look at Revenue growth trajectory and compare with the same accounts:

As you can see, Developer1 was in terms of revenue leading on 2016; but through the run down of next 4 years till 2020 they have lagged behind. AT the same time, sales of Macrotech (Lodha Group) have grown ~50%. “But what about the Consistency in Profitability?”

Profit (PAT) Growth Trajectory:

PAT has taken a dent in the last fiscal mainly due to macro slow down. If you compare with others you are still looking at a PAT that is way in cheaper valuations compared to 4 out of 5 other top developers. (refer Market Cap to PAT). Just to add a note the PAT of Developer 1 is supported disproportionately by other or non-operating income.

“But still the Debt is north of Rs:17000 Cr and Debt to Equity is of 4. How to overlook that?”

Don’t overlook Debt , let’s talk about it:

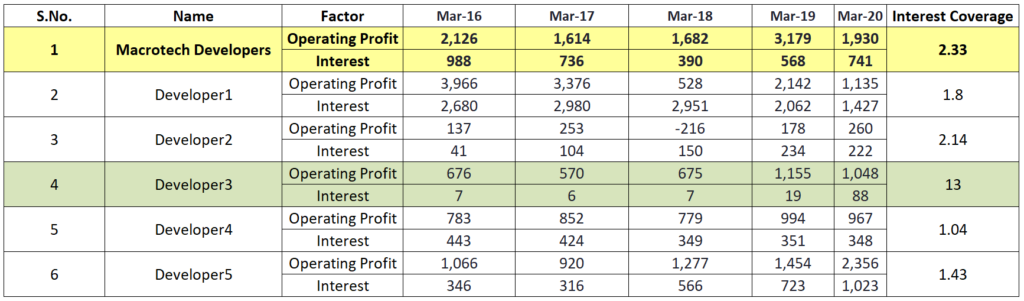

When it comes to judging the leverage of a company it is always the Interest coverage that is most significant. And one more very important indicator is the comparison between earnings from operations to the interest costs payable, because that is the core earnings of the company from its business, other incomes are one time or transient to say the least! You can see here that the operating income of most of these developers is diving straight to the levels of their leverage dues. This is not a good sign standing on Mar 2020 especially when you know what comes next. Macrotech in this respect is moderate. While in terms of Interest coverage apart from developer 3, Macrotech is in a marginally better scenario. Even Developer 2 which is one of the most trusted brands and part of a conglomerate is not in a good shape. Developer 3 trumps everyone in these metrics by far and we will discuss about this company at some other time definitely. In conclusion the metrics of Macrotech are in 2nd position in respect of leverage.

How these companies did in the latest fiscal? This is a dampener for those who have become Macrotech enthusiasts on the course of reading this. Let’s see:

Macrotech has made losses net-net in the previous two quarters. But the Q3 FY21 numbers are back on track and in Q3 they are no.1 in revenue and no.1 in Profit After Tax. Obviously if the second wave of you know what forces restrictions the industry as a whole will be affected. All the developers except developer 3 are functioning on leverage, thus in any time when the sales tap closes their numbers will suffer much more than developer 3. But Macrotech through this IPO has gathered enough cash to carry it through for a medium period of low macros.

Conclusion: Macrotech is a company of very large scale in its industry and in the future also it will derive its advantages. Abhishek Lodha has an ambitious target of making his company debt free in 3 years which we have to keep a watch on the progress of it. If you want to buy into real estate stocks at all you may watch how the bad loan scenario and the second wave scenario goes and then decide because both of the will affect this sector in a negative way. This company can give the scalability which generally real estate companies generally find difficult to achieve. It has shown consistency in growth. Debt remains an issue for the entire industry and Macrotech falls into the same scenario too. Also being an aggressor in real estate has its challenges in terms of legal litigations. In that respect my opinion is, the management has enough experience and knowhow to not step into unrecoverable scenarios, at least the history suggest so. Considering past performance and future expansion, liquidity through IPO, scale advantages, growth of the past, Team performance history, and valuations (refer market cap to revenue and profit comparisons at the beginning) I would say that Macrotech is a business worth exploring.

[Disclosure: I do not own Macrotech Developer Stocks & I have worked for Lodha Group in 2014-2015]

Leave a Reply